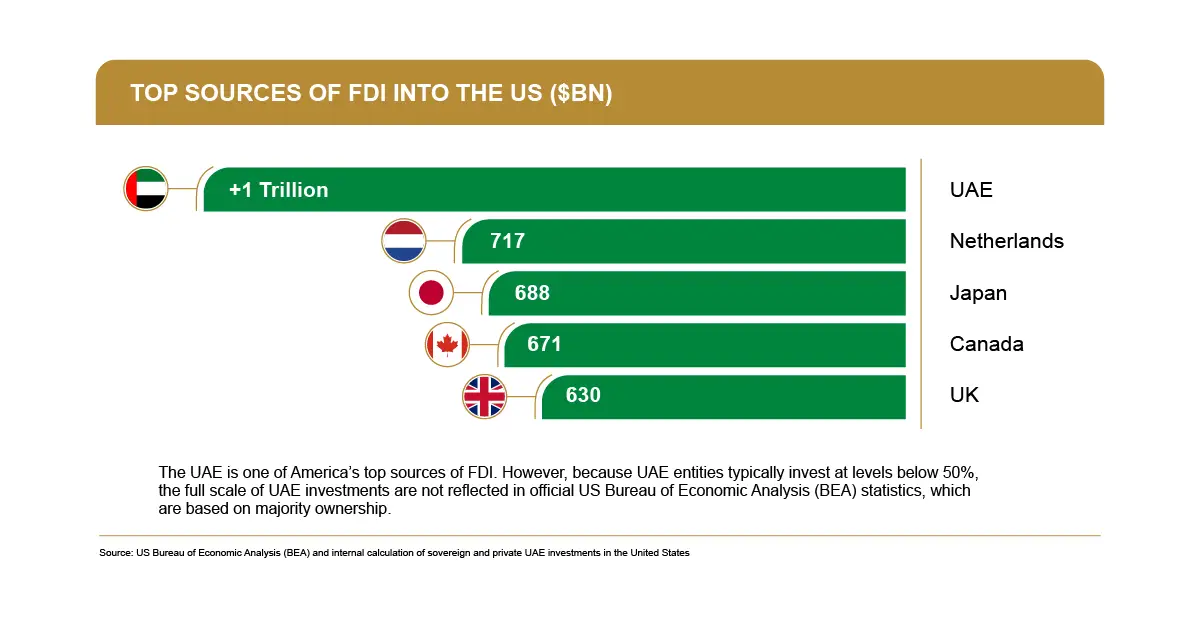

With a long track record of successful investment and trade, the UAE has a $1 trillion economic relationship with the US – and wants to do more. This is a result of direct investments in US companies and significant purchases of products and services across key sectors such as aerospace, energy, manufacturing, technology, life sciences and healthcare.

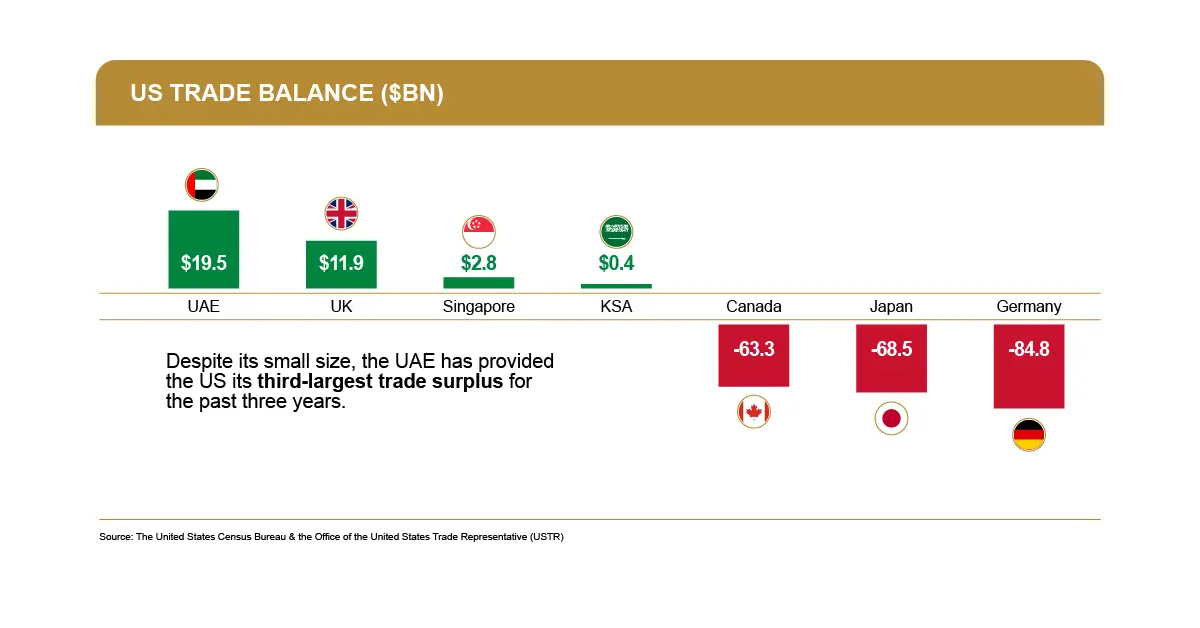

This mutually beneficial relationship serves all 50 US states and all the sectors that are creating American jobs and driving American innovation. The UAE is one of the US’s fastest-growing economic partners. In 2024, trade between the US and the UAE totaled $34.4 billion, with US exports to the Emirates making up nearly $27 billion.

The UAE is creating prosperity for American workers, growth for the economy and ensuring a more secure global supply chain for American products.

The UAE-US Strategic 10-year Investment and Trade Framework

The UAE is working with the Trump Administration to make a historic $1.4 trillion investment in the US over the next decade, fueling innovation in AI, clean energy, and advanced manufacturing, and creating new opportunities for American businesses and workers. This new investment builds on the existing $1 trillion economic relationship with the US and will increase total UAE investment to $2.4 trillion over the next ten years.

Specific, strategic investments will include:

Emirates Global Aluminium will construct the first new aluminum smelter in the US in 45 years. Located in Oklahoma, the $4 billion project will create thousands of American jobs and nearly double US domestic aluminum production.

ADQ and Energy Capital Partners have formed a $25 billion US energy venture to invest in power generation for data centers and Al projects.

ADQ and Orion Resource Partners have agreed to a $1.2 billion mining partnership to secure supplies of critical minerals.

Etihad Airways confirmed a $14.5 billion order for 28 Boeing 787 and 777X aircrafts equipped with GE engines.

UAE-US Tech Spotlight

Advanced technology is the newest pillar of the UAE-US relationship. From Nvidia, AMD and Microsoft to OpenAI and IBM, the UAE is forging deep partnerships with America’s leading technology companies.

G42, OpenAI, Oracle, NVIDIA, SoftBank Group Corp. and Cisco have partnered to build Stargate UAE – a 1GW AI compute cluster that will serve as the foundation of a 5GW UAE-US AI Campus in Abu Dhabi. This project builds on the “US-UAE AI Acceleration Partnership,” a government-to-government framework to deepen bilateral cooperation in AI and advanced tech.

Following Microsoft's expanded partnership and investment in Abu Dhabi's G42, the partners jointly launched the Abu Dhabi-based Responsible AI Foundation, which aims to promote AI best practices and industry standards in the Middle East and Global South. Microsoft also announced the Abu Dhabi expansion of its AI for Good Lab, which will leverage AI to help vulnerable communities worldwide.

Joint investments between the UAE and US are meeting the growing demand for advanced tech infrastructure and data centers. The UAE’s DAMAC Properties announced a $20 billion investment to build new data centers across the Midwest and Sun Belt. US private equity firm KKR and Dubai’s Gulf Data Hub (GDH) also announced a more than $5 billion investment to boost data center infrastructure in the Gulf.

Abu Dhabi’s G42 and California-based Cerebras Systems delivered Condor Galaxy, the world’s largest and fastest AI supercomputer.

BlackRock, Global Infrastructure Partners, Microsoft and MGX launched the AI Infrastructure Partnership (AIP) aiming to unlock up to $100 billion in investment for US data centers and related infrastructure. NVIDIA, xAI, GE Vernova and NextEra Energy later joined, boosting AIP’s technology leadership and energy expertise.

Amazon Web Services (AWS), e& and the UAE Cybersecurity Council unveiled the UAE Sovereign Launchpad, an initiative to accelerate cloud adoption in the public sector. The Launchpad establishes the UAE Cybersecurity Technology Innovation Bureau and is expected to unlock $181 billion in the UAE’s digital economy.

Oracle Health, Cleveland Clinic and G42 are developing an AI-driven healthcare hub to deliver affordable and effective healthcare worldwide. Launching first in the UAE and US, the platform is run on Oracle AI and cloud infrastructure.

The Abu Dhabi Investment Office announced a partnership with Qualcomm to establish an advanced global engineering center in Abu Dhabi focused on next-generation IoT, AI, and data center solutions.

Reliable Security Partners

The mutually beneficial economic relationship between the UAE and US is rooted in a deep defense and security alliance. The UAE is one of only three countries and the only Arab country to participate in all nine US-led coalition actions over the last 35 years.

As a CENTCOM partner, the UAE fights terrorism alongside the US against ISIS, Al Qaeda, Al Shabaab, and Iranian-backed militias such as the Houthis, and others

The UAE hosts and funds Hedayah, a global counter-extremism think tank created with the US & other partners. The US and UAE jointly created the Sawab Center to counter online extremist propaganda

From Al Dhafra Air Base, the US Air Force operates key aircraft platforms, hosting 3,500 US personnel - UAE and US pilots train together at the base's Air Warfare Center

The US Navy's Fifth Fleet relies on Dubai's Jebel Ali Port (JAP) for maritime security and resupply. JAP hosts more US naval visits than any port outside the US

Working with UAE partners